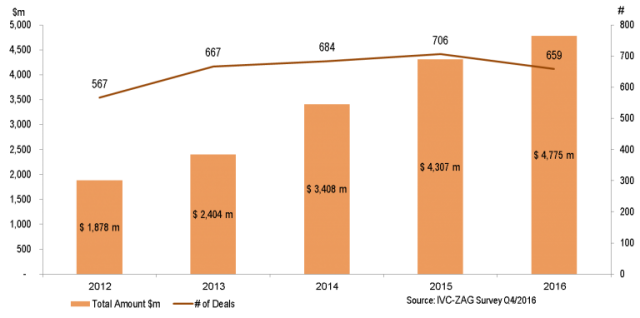

Israeli Hi-Tech Companies Raise $4.8B In 2016

The report also stated that the average financing round, which has been constantly growing over the past five years, reached $7.2 million in 2016, 19% above the $5.1 million five-year average. The fourth quarter of 2016, saw $1.02 billion raised in 151 transactions, down 8% from $1.11 billion in 202 deals in the corresponding quarter of 2015, but up 9% from $933 million raised in 140 deals in the preceding quarter. The average financing round stood at $6.7 million in the fourth quarter of 2016, similar to the past two-year quarterly average of $6.6 million.

IVC Research Center CEO Koby Simana explained in a statement, “As expected, 2016 ended as a record year in Israeli high-tech capital raising. However, despite the higher total amount, it was characterized by a smaller number of financing rounds, along with a higher average capital raising per round. When we looked into the numbers to try and explain the trend, we found what I would call a ‘B Crunch’ – a 30% drop in the number of second rounds closed in 2016 compared to 2015, while the number of earlier rounds slightly increased. This is a troubling trend for the Israeli VC funnel, since the majority of capital goes into later rounds – if there are no companies lined up for later investments, there could be a more serious issue later on.”

Fewer than expected financing rounds

The survey also revealed that, while capital-raising reached new heights in 2016, the number of financing rounds were fewer than expected, with 659 deals closed in 2016, marginally above the five-year average of 657 deals, and 7% below 2015’s record 706 deals. While the number of early rounds (seed and A rounds) increased slightly (5%), the number of B rounds dropped 30% and the number of later rounds – C or higher – was responsible for more than 60% of the capital, down 11% from 2015. B rounds’ share of capital raising also decreased, falling from 25% in 2015 ($1.07 billion) to 16% in 2016 ($743 million), while early rounds and later rounds generated more capital and took up larger shares than the year before.

Israeli VC funds invest $634 million

Israeli venture capital funds invested a total of $634 million in Israeli high-tech companies in 2016, slightly up from $627 million invested in 2015. In the past five years, Israeli venture capital fund investments steadily increased, from $482 million in 2012 to the current level. At the same time, their share of total capital invested has been decreasing gradually, from 26% in 2012 down to 13% in 2016, the lowest yet.

In the fourth quarter of 2016, $111 million was invested by Israeli venture capital funds in local high-tech companies, 44% below the $198 million invested in the corresponding quarter of 2015 and 20% below the $139 million invested in the preceding quarter of 2016. Israeli venture capital funds’ share was down to 11% in the fourth quarter of 2016, from 18% and 15% in the corresponding quarter of 2015 and the preceding quarter of 2016, respectively.

Leader in funding: Software companies

Software companies led capital-raising in 2016 with $1.7 billion, up from 2015 when the sector attracted $1.4 billion (32%), also placing first. Internet capital raising has noticeably decreased in 2016, when the sector attracted only $744 million or a mere 16% of total capital, compared twith $1.12 billion raised in 2015, when Internet placed second with a 26% share.

Regarding the statistics presented in the report, Shmulik Zysman, founding partner of ZAG-S&W (Zysman, Aharoni, Gayer & Co.) was optimistic, but cautious “We expect the uptrend in capital raising activity to continue in 2017, though possibly at slower rates,” he said in a statement.